Summary: The surge of new weight loss medications, including Ozempic and Wegovy, has altered healthcare markets and influenced investment decisions. Although these drugs threaten traditional bariatric procedures, long-term usage challenges, side effects, accessibility issues, and economic factors suggest that medical device sectors may remain resilient and adaptable.

Keywords: Weight loss drugs, bariatric surgery, medical devices, Ozempic, Wegovy, healthcare investment

The Rapid Rise of Weight Loss Medications

In 2023, the global healthcare landscape began witnessing a remarkable shift, as several weight loss medications—most notably Ozempic and Wegovy—surged in popularity. These drugs offered hope to countless individuals struggling with obesity, providing them with a potential non-surgical, pharmacological route to meaningful weight reduction. Such developments triggered rapid changes in investor behaviour, prompting a reassessment of the outlook for medical device companies that specialise in bariatric surgical solutions. As analysts and stakeholders grappled with the potential long-term implications of pharmaceutical interventions on devices designed to facilitate weight loss, a fundamental question emerged: How would these new treatments influence the future of the medical device sector?

While some observers initially raised alarms, pointing to the possibility that weight loss drugs could obviate the need for surgical solutions and thus challenge the conventional revenue streams of medical device companies, industry leaders remained largely untroubled. The reasoning behind their calm was multifaceted. For one, issues such as the high cost and limited accessibility of weight loss drugs were predicted to limit their penetration into all patient demographics. Furthermore, concerns over side effects and the feasibility of maintaining patients on these medications for long durations suggested that surgical and device-based interventions would retain a significant role. In the meantime, alternative solutions such as incorporating a meal substitute shake into daily routines have emerged as more accessible, non-invasive options for managing weight.

In order to understand the full impact of weight loss drugs on the medical device sector, it is essential to examine the complex interplay of economic forces, patient needs, regulatory environments, and the shifting landscape of healthcare provision. The following sections will provide a comprehensive exploration of these factors, ultimately revealing that the relationship between emerging weight loss pharmaceuticals and medical device companies is more nuanced, interconnected, and adaptive than initially perceived.

In recent years, obesity rates have soared worldwide, placing immense strain on healthcare systems and prompting both public and private sectors to seek new solutions. Ozempic and Wegovy, two weight loss drugs derived from glucagon-like peptide-1 (GLP-1) receptor agonists, captured the global imagination by promising meaningful and sustained weight reduction without the immediate invasiveness and potential complications associated with surgery.

Their ascent was rapid. Advertising campaigns, celebrity endorsements, and extensive coverage in medical journals underscored their potential to help individuals shed unwanted kilograms and reduce obesity-related comorbidities. Patients who had previously considered bariatric surgery as a last resort found themselves presented with a less invasive pharmaceutical alternative. Investors took note, recognising these drugs as a potential disruptor to longstanding models of obesity treatment. Soon, medical device stocks—particularly those linked to surgical weight loss interventions—experienced tremors as financial markets recalibrated their expectations.

Potential Threats to Medical Device Companies

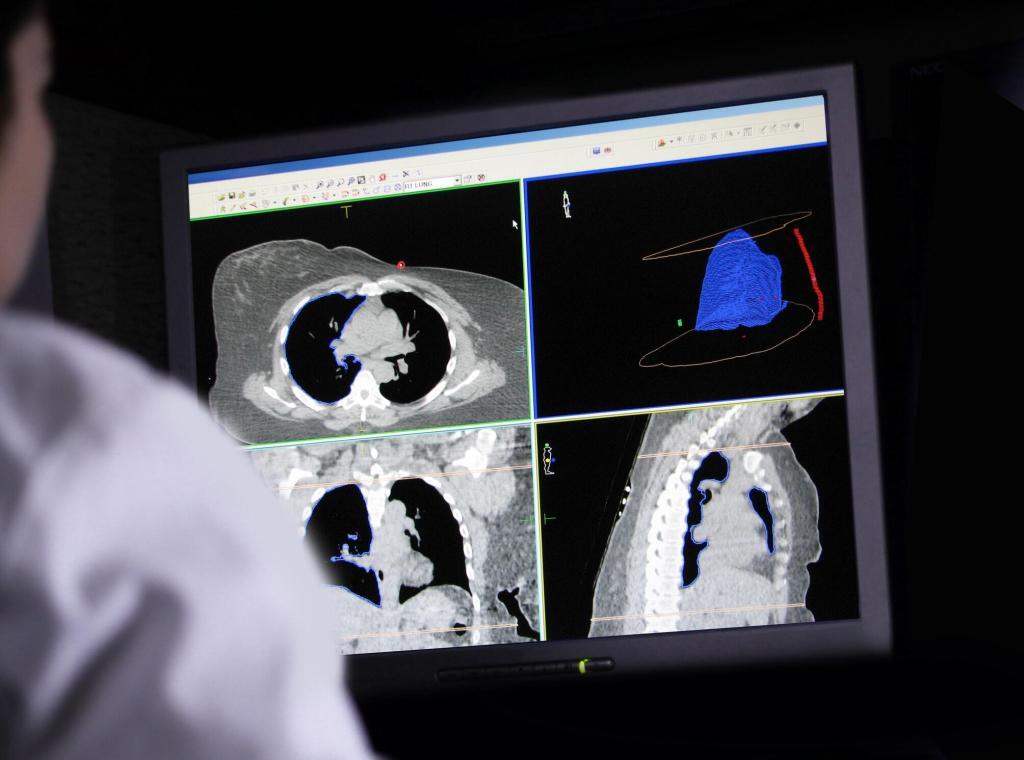

For decades, the medical device industry has benefited from a steady demand for bariatric surgery. Gastric bands, balloons, and bypass procedures have offered a reliable revenue stream, and surgical techniques have improved to become safer and more effective. Yet, the possibility that an easily accessible medication could significantly reduce obesity rates and curtail the need for device-based interventions created uncertainty.

Should a critical mass of patients find that regular injections or pills could safely deliver the weight loss results they seek, hospital admissions for bariatric procedures might decline. This scenario would threaten a previously stable market segment. The mere perception of such a possibility, even before actual decreases in surgical volume, can depress investor confidence and harm share prices, as witnessed several months ago when medical device stocks dipped sharply.

Counterbalancing Factors: Costs, Accessibility, and Duration of Use

Although weight loss drugs have captured headlines, the real-world constraints on their widespread adoption cannot be ignored. Firstly, these pharmaceutical options often come with high price tags, limiting their accessibility to affluent individuals or those with comprehensive insurance coverage. This leaves a substantial portion of the obese population either unwilling or unable to pursue long-term pharmaceutical interventions.

Moreover, healthcare systems and insurers may hesitate to cover these expensive treatments indefinitely, particularly if long-term data on safety and effectiveness remain limited. Patients, in turn, may struggle to adhere to the regimen required to maintain the benefits. While surgical interventions typically involve a one-time cost (albeit a substantial one), pharmaceutical treatments demand ongoing expenditure for as long as the patient desires to keep the weight off. Over time, these financial and practical constraints may create a natural ceiling on the market penetration of weight loss drugs.

Side Effects and Regulatory Hurdles

Every medication comes with potential side effects, and weight loss drugs are no exception. Patients and healthcare providers must carefully weigh the risks and benefits before embarking on a pharmaceutical weight loss journey. Nausea, gastrointestinal distress, and even rarer, more serious complications could discourage long-term usage.

Regulatory bodies, such as the Medicines and Healthcare products Regulatory Agency (MHRA) in the United Kingdom and the European Medicines Agency (EMA), will also continue to scrutinise these drugs closely. The release of long-term safety data may shape clinical guidelines and reimbursement policies. If regulators recommend restrictive usage guidelines due to side effect profiles, the opportunity for weight loss drugs to fully displace surgical interventions may remain limited. Conversely, if regulators endorse these drugs wholeheartedly, that might shift the balance somewhat—but this remains uncertain.

Patient Adherence and Long-Term Outcomes

Unlike a surgical intervention that provides a relatively permanent structural change to the patient’s physiology, weight loss drugs require sustained patient adherence over time. Many individuals find it challenging to maintain strict medication regimens, particularly when undergoing a lengthy treatment course. This difficulty is compounded by the fact that obesity is a complex chronic condition influenced by psychological, social, and economic factors.

For patients who initially achieve weight loss with medication, maintaining those results can prove challenging if they discontinue treatment. The possibility of “rebound” weight gain may drive some patients to eventually consider surgical or device-based solutions that offer more permanent results. Thus, even in an environment where weight loss drugs are readily available, the demand for bariatric procedures and related medical devices may persist as patients recognise the limitations of pharmacological management.

The Adaptive Nature of the Medical Device Industry

One must consider the inherent resilience and adaptability of the medical device sector. Throughout history, the industry has weathered myriad challenges, from regulatory shifts to technological disruptions. When confronted with a potential threat, leading medical device companies typically invest in research and development, exploring new avenues and creating innovative solutions that cater to emerging patient needs.

For instance, manufacturers of bariatric surgery equipment may diversify their product lines, investing in less invasive device-based options or diagnostics that complement pharmaceutical treatments. They might also collaborate with pharmaceutical companies to develop integrated approaches—combining drugs and devices to achieve optimal patient outcomes. Instead of viewing new weight loss medications purely as competition, the medical device sector could embrace them as an opportunity to expand their portfolio and enhance patient care.

The Role of Healthcare Providers

Clinicians and healthcare providers will continue to wield significant influence over treatment choices. They must weigh up the pros and cons of surgical interventions versus pharmaceutical solutions for each patient’s unique circumstances. Factors such as a patient’s overall health, comorbid conditions, access to insurance, and personal preferences all influence these decisions.

Consultants specialising in obesity management may encourage some patients to trial weight loss drugs as an initial approach while recommending surgical interventions if pharmacological treatments prove insufficient or unsustainable. Primary care physicians, nurses, and dietitians can guide patients toward evidence-based, long-term strategies that combine medication, lifestyle changes, and, in some cases, device-based solutions. This multifaceted approach ensures that medical devices remain a key component of the overall obesity treatment toolkit.

Economic and Investment Perspectives

From an investment standpoint, the rise of weight loss drugs has introduced new variables into the valuation of medical device companies. Initially, investor anxiety was palpable, as reflected in the tumbling share prices seen earlier in 2023. Yet, seasoned analysts and executives understand that temporary market jitters rarely equate to long-term sector collapse.

While some investors may reduce their exposure to medical device stocks out of caution, others recognise potential opportunities as share prices dip. Savvy investors may view the market disruption as a buying opportunity, anticipating that the medical device sector will adapt and regain momentum as new data clarifies the roles of medications and devices in obesity management.

Moreover, the healthcare market is not monolithic. What holds true in one region may differ elsewhere, influenced by local regulatory frameworks, insurance systems, cultural attitudes towards obesity and surgical interventions, and the strength of public health campaigns. Medical device companies may shift focus towards emerging markets where pharmaceutical treatments remain less accessible or less accepted, thereby diversifying their revenue streams and insulating themselves from overreliance on any single treatment modality.

The Importance of Long-Term Data and Clinical Evidence

As weight loss drugs become more established, a growing body of long-term data will emerge, providing crucial insights into their efficacy, safety, and patient adherence profiles. Clinical trials, post-marketing surveillance, and real-world evidence studies will help clinicians and policymakers understand how these treatments work over extended periods, who benefits most, and which patients might be better served by surgical solutions.

This evolving evidence base will guide healthcare decisions, insurance coverage policies, and reimbursement frameworks. Over time, it may emerge that weight loss drugs are most effective as a bridge therapy—helping patients lose initial weight before undergoing a less invasive bariatric procedure, or as a maintenance measure post-surgery. If this synergistic approach proves to be the case, medical devices would continue to play an essential role, even in an age of highly effective pharmaceutical interventions.

Societal and Cultural Factors

Obesity is not merely a medical condition; it is deeply embedded in social, cultural, and economic contexts. The stigma surrounding obesity, varying cultural attitudes towards surgical interventions, and public perceptions of medication use all affect patient choices. Some patients may prefer a single surgical intervention to the ongoing visibility of taking medication, while others may dread the prospect of surgery and opt for pharmaceutical approaches, even if they must continually manage their regimen.

These complex social dimensions help ensure that no single treatment—drug or device—will universally dominate. The healthcare landscape thrives on diversity, providing multiple paths to better health. Medical device manufacturers who understand and appreciate these cultural nuances can tailor their offerings to suit the preferences and priorities of different patient populations, thereby maintaining relevance and market share.

Regulatory and Policy Considerations

Regulatory frameworks and policy decisions will shape the environment in which weight loss drugs and medical devices coexist. Governments face mounting healthcare costs related to obesity, leading them to consider policies that promote prevention, early intervention, and effective treatments. Policymakers may support pharmaceutical interventions through subsidies or provide incentives for devices that improve patient outcomes and lower healthcare expenditures over the long term.

In the United Kingdom, the National Institute for Health and Care Excellence (NICE) plays a pivotal role in evaluating medical technologies, including drugs and devices. NICE guidelines, informed by cost-effectiveness analyses and clinical evidence, influence commissioning decisions within the National Health Service (NHS). If NICE and similar bodies determine that weight loss drugs alone are insufficient to address obesity on a population level, medical devices will remain part of the recommended toolkit.

The Interplay Between Pharmaceutical and Device Innovation

The emergence of new weight loss drugs should be seen in the broader context of ongoing medical innovation. Pharmaceuticals and medical devices do not exist in isolation; they often complement one another. For instance, advanced diagnostic devices can identify patients who are most likely to benefit from pharmaceutical treatments. Surgical devices might be refined to accommodate patients who have already lost weight through medication, reducing surgical complexity and risk.

Medical device companies can also invest in research that integrates pharmaceuticals with device-based monitoring systems. Imagine a world where wearable technology tracks patient biomarkers, providing feedback that helps clinicians adjust medication dosages or schedule surgical interventions at the optimal time. Such integrated solutions can improve patient outcomes and ensure both pharmaceuticals and devices play meaningful roles in obesity management.

The Resilience of Bariatric Surgery

While weight loss drugs may reduce the immediate need for some bariatric procedures, bariatric surgery remains a critical component of obesity care. Surgery can offer dramatic and sustained weight loss outcomes that are difficult to replicate through medication alone, especially for patients with severe obesity. It also addresses some of the underlying physiological mechanisms of weight gain, altering gut hormone levels, intestinal flora, and nutrient absorption patterns.

For patients who have struggled with repeated attempts at weight reduction—be it through diet, exercise, medication, or less invasive devices—bariatric surgery may still represent the most definitive solution. This ensures that the market for surgical devices will persist, even as weight loss drugs gain traction. Moreover, bariatric surgery and related devices may find a stable niche in treating patients for whom medication is contraindicated or intolerable due to side effects.

Long-Term Predictions and Market Forecasts

Attempting to forecast the long-term interplay between weight loss drugs and medical devices is challenging. It hinges on numerous uncertain variables: how effectively pharmaceutical companies address cost and accessibility barriers, whether long-term safety data confirm or refute initial excitement, how regulators respond to emerging evidence, and whether patients embrace or reject ongoing medication use.

Nonetheless, a plausible scenario emerges from these uncertainties. Weight loss drugs will likely become a well-established component of obesity management, particularly for individuals who have the means and motivation to adhere to the treatment regimen. Yet, their existence will not eliminate the need for surgical interventions and medical devices. Rather, the market may become more segmented: some patients will rely solely on medication, others will eventually turn to surgery, and many will traverse a treatment pathway that involves multiple strategies over time.

Medical device companies, anticipating these shifts, may strengthen their partnerships with pharmaceutical firms, invest in R&D that optimises device usage after or alongside medication therapy, and refine their surgical tools to become more patient-friendly and minimally invasive. Such efforts ensure that the device sector is not only preserved but potentially enhanced through synergistic relationships with the pharmaceutical industry.

Implications for Patients and Public Health

Ultimately, what matters most is patient wellbeing and public health outcomes. The introduction of effective weight loss drugs is good news insofar as it expands the range of treatments available to individuals struggling with obesity. Obesity-related conditions—such as type 2 diabetes, cardiovascular disease, and joint problems—place enormous burdens on healthcare systems. The more tools available to clinicians to manage and prevent these conditions, the better the overall health outcomes.

If pharmaceutical weight loss options co-exist with surgical and device-based interventions, patients stand to benefit from more personalised and flexible care pathways. A patient who initially tries medication might later choose a device-based solution if their medication proves less effective or too costly. Another patient might prefer a surgical intervention from the outset. This multiplicity of options allows for more nuanced decision-making and better alignment with individual patient values, circumstances, and long-term health goals.

Conclusion

The arrival of high-profile weight loss medications such as Ozempic and Wegovy in 2023 instigated considerable debate and uncertainty within the medical device sector. Although initial reactions from the investment community suggested these drugs posed an existential threat to device companies reliant on bariatric procedures, a deeper examination reveals a more complex narrative.

High costs, limited accessibility, side effects, regulatory scrutiny, and the challenges of long-term adherence place practical limits on the extent to which these drugs will displace surgical interventions. Patients, faced with a range of treatment options, are unlikely to abandon medical devices entirely. Instead, they will make informed choices, guided by healthcare professionals and influenced by personal preferences, cultural norms, and economic realities.

Medical device companies have endured upheavals before, and their capacity for innovation, adaptation, and market diversification should not be underestimated. By capitalising on their strengths, collaborating with pharmaceutical companies, and continually refining their offerings, medical device manufacturers can remain integral players in the evolving landscape of obesity management.

In the final analysis, weight loss medications and medical devices need not be adversaries. They can exist in harmony, each addressing different patient needs and preferences, and together forming a robust arsenal against a global health challenge that demands multifaceted solutions.

Disclaimer

The content provided in this article is for informational purposes only and does not constitute medical advice, diagnosis, or treatment. Readers should consult qualified healthcare professionals before making any decisions regarding medical treatments, including the use of weight loss medications or undergoing bariatric procedures.

Open Medscience does not endorse or recommend any specific pharmaceutical product, medical device, or treatment regimen mentioned herein. The inclusion of brand names such as Ozempic and Wegovy is purely for illustrative purposes and does not imply endorsement.

Furthermore, this article may discuss financial trends or market impacts relating to healthcare investments. Such information is intended solely for general insight and should not be interpreted as investment advice. Readers are encouraged to seek guidance from a licensed financial advisor or conduct independent research before making any financial decisions.

While every effort has been made to ensure the accuracy and reliability of the information provided at the time of publication, Open Medscience accepts no responsibility or liability for any loss, damage, or harm resulting from reliance on the content of this article.

home » blog » medicine »